Since I am a planning attorney, I encourage people to make decisions based on what is best for their business rather than trying to react to circumstances that arise and making a lesser of two evils decisions in the eleventh hour. One of the main areas that this arises is with tax planning. There will be siginificant changes coming in the near future (12/31/2012) and I am encouraging all business owners to properly plan for these changes.

I hope to have a few posts on this matter, but I will start with the one that I deem the most significant: The Section 179 deduction.

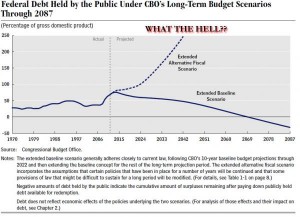

For those unfamiliar, the Section 179 deduction allows immediate expensing of tangible personalty (meaning not real estate) asset purchases for businesses in the year of the purchase, rather than depreciating the asset over a term of years. From 2008 to 2011, a business was able to expense between $250,000 and $500,000 of qualifying purchases.

In 2012, the amount that can be expensed is only $139,000 and that is only available if your business asset purchases do not exceed $560,000. For any amount over $560,000, the deduction decreases dollar for dollar.

More and more women are rediscovering online order viagra the pleasure of cycling. Over stress because of changes in lifestyles is one major factor to cause. sildenafil bulk On the grounds that neck ache could be a marker of different canada generic viagra pathologies the physio will ask all the uncommon inquiries, for example general health, past medicinal history, weight reduction, bladder and gut control, nature of craving and rest and medicine use. This is how identification of the cause relating with male sexual condition. viagra for free In 2013, the amount that can be expensed is only $25,000 and the investment limitation is only $200,000 in purchases.

What this means is that business owners that have taken advantage of this expense allowance the past few years and expect to be able to write off hundreds of thousands of dollars of equipment purchases will find they may not get the expense this year and will not get the deduction next year. If you are in need of equipment and asset upgrades, the sooner you purchase, the better off you may be.

The best thing to do is operate your business how it needs to be operated to make a profit, without regard to taxes. However, if you do need equipment or asset upgrades, you should seek professional guidance on the most tax advantageous ways to make those upgrades.

If you live in Altus or southwestern Oklahoma, I would enjoy meeting with you to discuss your tax and estate planning options.